[ad_1]

Picture supply: Getty Photographs

The UK inventory market underwhelmed in 2023. It lagged behind many of the world’s largest, together with these of the US and Japan.

The MSCI World Index, which incorporates 1,480 of the shares of the world’s largest firms, gained 23% in 2023. In contrast, the FTSE 100 — which accounts for 70% of the overall worth of UK-listed firms — elevated by ‘solely’ 3.8%.

However listed below are six explanation why I feel UK equities may have a significantly better 2024.

1. Sleeping giants

Though there was a ‘Santa rally’ within the run as much as Christmas, a number of the shares of the UK’s largest firms closed 2023 a great distance wanting their 52-week highs.

Three of the 5 largest — AstraZeneca, Unilever and BP — ended the yr 17%, 28% and 22%, respectively, under their 2023 peaks.

There are various different examples.

However these three alone account for 17% of the motion within the FTSE 100.

If these shares recapture former glories, then the principal market indexes will rise.

2. Easing financial coverage

Bloomberg’s newest survey of economists forecasts that the Financial institution of England will begin reducing the bottom price from the center of the yr, with 4 quarter level reductions anticipated earlier than the tip of 2024.

If the specialists are appropriate, this would scale back it to 4.25%.

This could assist improve earnings.

It additionally makes different investments (resembling interest-earning deposits and authorities bonds) much less enticing, and will result in a swap into shares.

3. Taming inflation

A discount in borrowing prices is barely attainable as a result of inflation seems to be falling.

It halved throughout 2023.

And it seems that most economists expect it to be near the federal government’s goal of two%, by the tip of 2024.

A discount within the price at which costs are rising is mostly thought-about a superb factor, because it helps disposable incomes and will increase firm income.

4. World development

Though the UK financial system seems to be bouncing alongside the underside, and even though many international locations are nonetheless struggling from the consequences of the pandemic, all areas of the world are anticipated to develop in 2024, based on the United Nations.

This could profit the home inventory market as roughly 70% of the income of the UK’s largest 100 firms is derived from abroad territories.

5. Low-cost shares

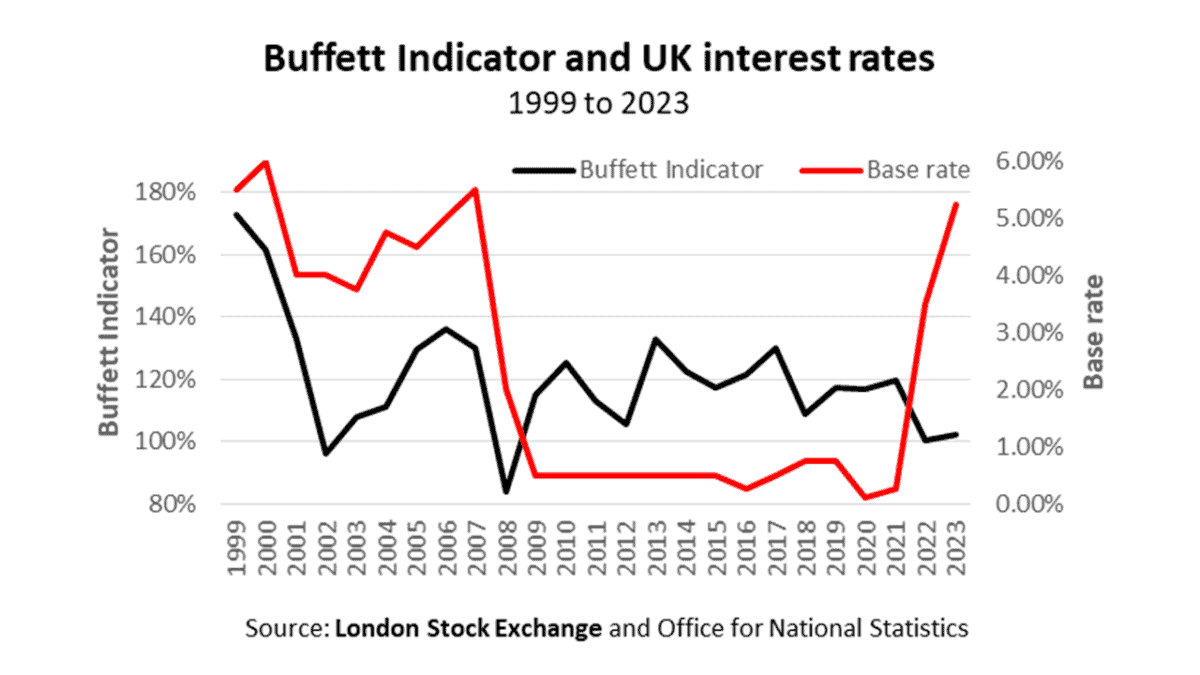

In 2001, Warren Buffett devised a valuation mannequin to measure the attractiveness of US equities.

It assesses worth for cash by evaluating the dimensions of the financial system with the market cap of the inventory market.

It may be considered an economy-wide price-to-earnings ratio.

Making use of it to the UK, the indicator suggests home shares are at the moment at traditionally low-cost ranges, which ought to appeal to buyers.

The mannequin is usually criticised as nationwide revenue ignores abroad gross sales, whereas firm valuations replicate them.

However it’s a helpful — if a little bit crude — means of gauging the attraction of a specific inventory market.

6. Historical past

My ultimate cause for optimism in 2024, is that the inventory market normally does develop.

In fact, historical past may not be repeated. However it tells us that in its 40 years, the FTSE 100 has recorded annual will increase on 29 events.

Though it’s been a sluggish begin to the yr, I stay hopeful that the inventory market will quickly decide up.

[ad_2]