[ad_1]

Method again within the Nineties, all of us talked about object-oriented architectures and modular computing. Within the 2000s, I referred to as it Banking-as-a-Service, BaaS, and began presenting the concept around the globe.

The distinction between the Nineties and 2000s was cloud and cell smartphones. This variation was the tipping level from fragmented programs to open platforms, and the transfer to apps and APIs.

Twenty years later, we take BaaS as a right and speak about ecosystems and open banking however, tracing its roots, it goes means, means again to the concept of breaking down banking processes and automating them with plug-and-play software program. This permits us to take all of the items and substances of a monetary course of and recreate it in minutes. Taking that one step additional, and this was my concept of the 2000s, you can take heaps and many start-up suppliers of monetary companies and create your individual financial institution. Right here’s that slide (2009):

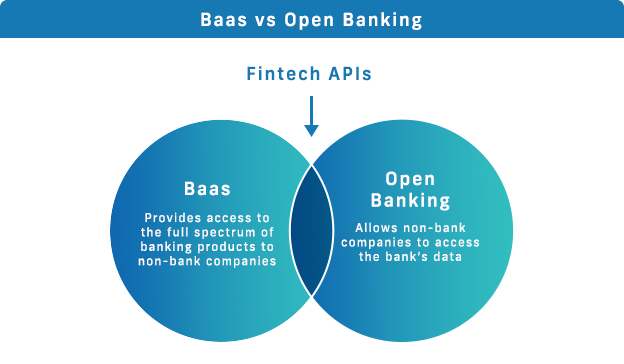

I assume the most important change is that nearly each single course of inside a financial institution now has a third-party API that you may shortly plug into the ecosystem to construct a financial institution. This is the reason we’ve so many fintech corporations succeeding by specialising in a part of the method of finance, moderately than the entire building of a financial institution.

However what does this imply to banking sooner or later? Properly, the most important query needs to be round threat and regulation. How are the various elements of the monetary system structured, regulated and who will probably be accountable if all of it goes incorrect?

These are the questions all the time requested by yours actually when putting my cash someplace. Is it assured and lined by a monetary compensation scheme? So far as I’m involved, it’s then the corporate – the financial institution – who’re accountable for my cash and guaranteeing its security.

The problem this raises if the financial institution brings in a 3rd get together to run a part of their processes, they’re now not in management and, as a result of they’re accountable for all threat and regulation, they due to this fact don’t wish to deliver of their events to their processes.

Nonetheless, with extra micro laws to supply emoney suppliers and extra, the marketplace for cash is turning into way more granular. By means of instance, there are virtually a dozen in Estonia, they usually appear to be rising by the day:

- Digital Foreign money Change license and e-wallet license

- Monetary Establishment license

- E-money Establishment license

- Fee Establishment license

- Funding Agency license

- Fund Supervisor license

- Credit score middleman license

- Credit score establishment license

- Insurance coverage dealer license

- Insurance coverage firm license

- Journey Endeavor license

These licensing programs from regulators will get increasingly more regulator, and the purpose I made again within the 2000s is that no buyer desires to do the due diligence of 1,000 start-ups to see if they’re licensed and controlled. I would like my financial institution to do this.

In different phrases the function of a financial institution as of late is to curate the fintech ecosystem and usher in trusted third events who’re regulated and have been vetted by the financial institution to be a part of their platform. This level is nothing new – I used to be saying it virtually twenty years in the past – nevertheless it very exhausting for a lot of banks to just accept as they nonetheless consider they must do the whole lot internally to regulate the danger exposures.

I do know that is altering, however it is usually clear that many financial institution leaders and inside cultures are nonetheless pushing again in opposition to such a construction. If that is true, it’s a financial institution that gained’t be round for for much longer as there are many new banks which are doing this rather well. Simply check out 11fs Foundry, Starling Financial institution’s Engine or Solaris Financial institution’s APIs. There are lots of different BaaS suppliers on the market – banks that provide API companies to automate processes by way of plug-and-play software program, together with Clear.Financial institution, Treezor, Intergiro, Finastra and extra.

The BaaS market has developed and developed over three a long time right into a mature market that conventional banks have to embrace. It’s not an ecosystem. It’s an open system.

Supply: SEPA-Cyber Applied sciences

[ad_2]