[ad_1]

I noticed an attention-grabbing remark the opposite day that acquired numerous shares, likes and clicks: fintech founders MUST have some expertise in banking or monetary companies background first earlier than they’re funded. Many fintech neophytes destroy a lot worth not out of deliberate actions however simply pure ignorance.

Funnily sufficient the particular person making this remark did say it might be unpopular, however he bases his opinion on how bankers assess danger. That’s why I significantly appreciated a touch upon the thread from Hafiz, a founder and VC, who states: one of many key expertise of a very good banker is sound danger evaluation expertise together with accounting understanding. A key ability for managing any firm dimension.

This debate has been effervescent for years and strikes to the center of my parent-child dialogue.

of fintech. So, let’s be clear: a fintech founder doesn’t have to have labored in finance. There are lots of good fintechs on the market who haven’t any monetary folks of their origins. Stripe – based by two Irish guys who understood tech; Klarna – began by three mates who have been flipping burgers; PayTM – based by a man who was homeless, however had a very good telecoms information; Clearbank and RTGS based by Nick Ogden, who based WorldPay; and there’s extra.

Having mentioned that, a few of the different most profitable fintechs have been based by folks with good banking backgrounds. Starling – based by Anne Boden, as a seasoned monetary skilled; NuBank – co-founded by David Velez, previously concerned in funding banking and enterprise capital; Metro, Atom, 86400 and Archie – based by Anthony Thomson who has spent his complete life immersed within the monetary markets and advertising; and extra.

There isn’t a golden rule right here, besides one. If the FinTech has nobody on the board or govt or advisory staff who has gray hair, then it worries me. It goes again to that parent-child factor. I have to see somebody who has wrinkles and expertise within the founding staff and, even higher, somebody who has labored in finance.

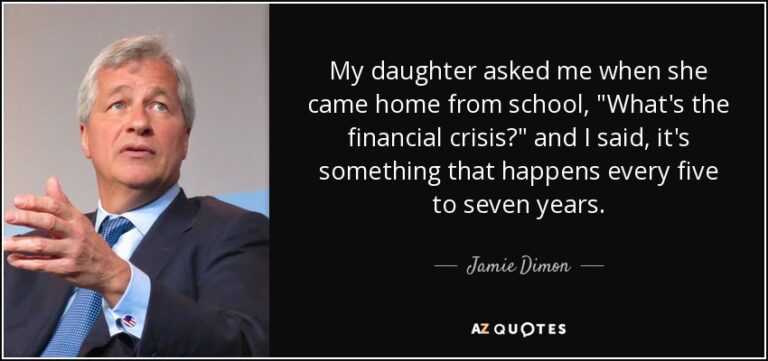

One of the best ways for example that is in these immortal phrases of the world’s main banker, Jamie Dimon. After the large monetary disaster of 2008, when JPMorgan bailed out Washington Mutual and Bear Stearns, Jamie talked about that his daughter requested him “What is the monetary disaster?”. His reply? “One thing that occurs each 5 to seven years”.

It’s that information, depth and understanding of the cycle of finance that’s key to fintech corporations success, as it’s far too simple to start-up after which need to shut-down. Few fintech corporations have been by way of the disaster of confidence now we have seen over the previous two years in the fintech massacre and crypto winter. People who have had sage recommendation and oversight are doing properly; people who had pure enthusiasm could crash and burn.

[ad_2]