[ad_1]

Picture supply: Getty Pictures

The Diageo (LSE:DGE) share worth has been buying and selling under £30 since dropping under the important thing worth degree in November final yr.

The state of affairs mimics comparable actions in 2019, when the value remained above £30 briefly earlier than falling under it. The shares then struggled to interrupt again above £30 till April 2021. If the value degree proves to be as growth-resistant this time, it could possibly be a very long time earlier than Diageo makes important positive factors.

However issues are completely different now. In 2020, markets had been battered by the pandemic. In 2021, they had been shored up by stimulus cheques. Now, neither issue exists. So the place’s the value headed?

How are the books trying?

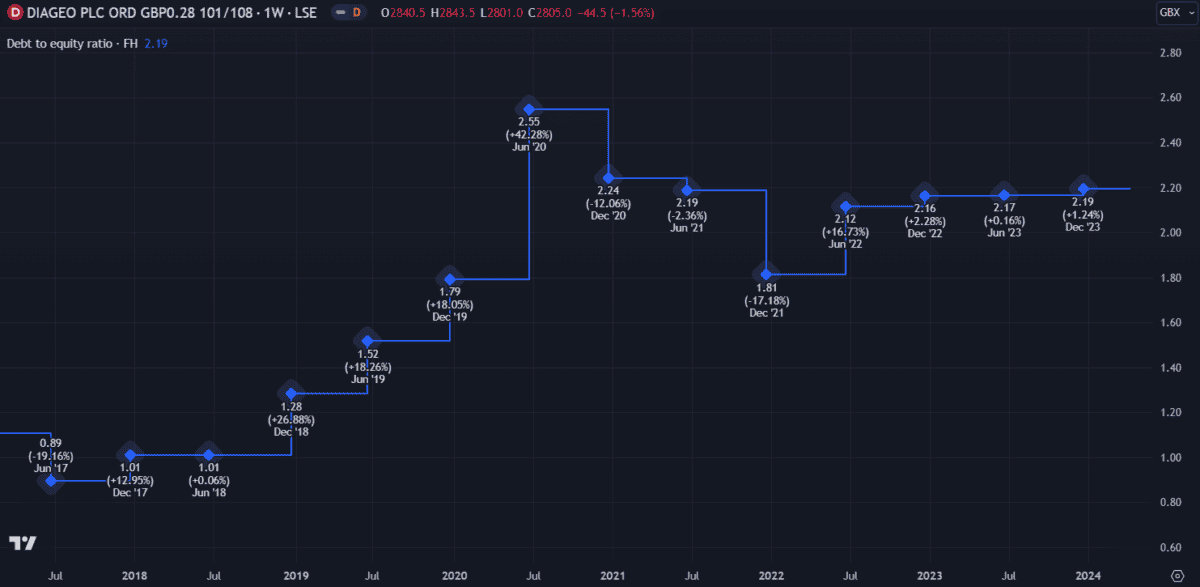

Diageo has a reasonably clear steadiness sheet regardless of excessive debt. Its debt-to-equity (D/E) ratio shot up throughout the pandemic however has recovered and remained secure since. Though it’s excessive, it’s well-covered by working money move and curiosity funds have a protection ratio of seven.2.

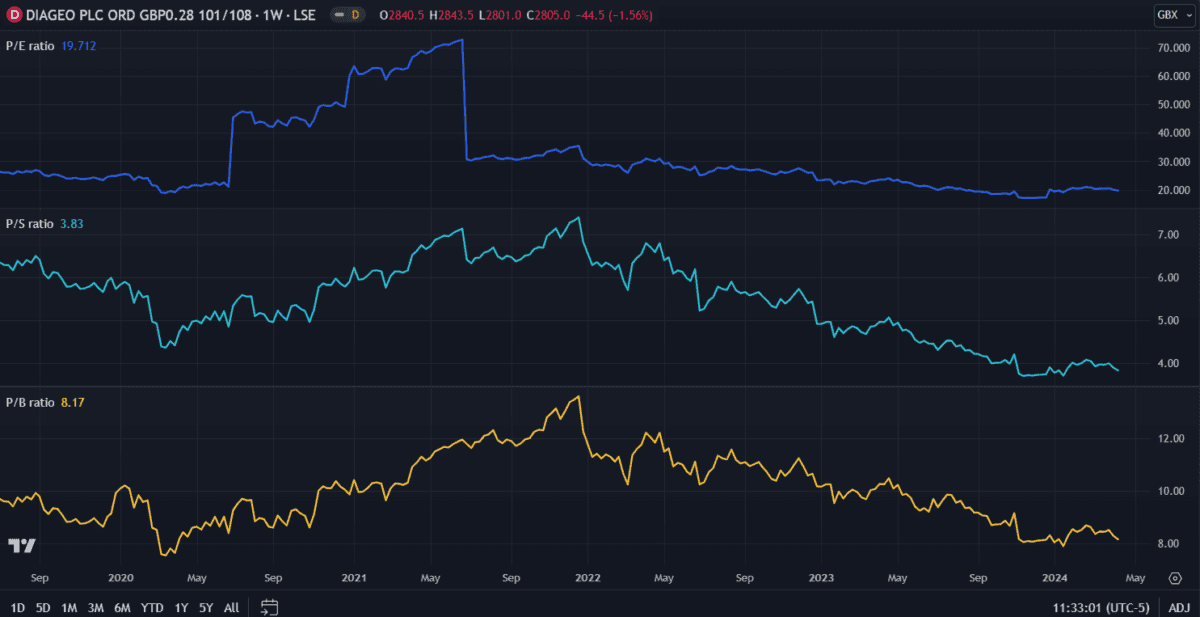

With a £78.8bn market cap and £4.26bn in earnings, Diageo has a comparatively excessive price-to-earnings (P/E) ratio of 18.5. This can be a trailing (that’s, primarily based on previous figures) ratio, however with earnings anticipated to stay secure, the ahead P/E ratio is barely barely increased.

Business friends like Related British Meals and Coca-Cola HBC have barely decrease P/E ratios, on 17.4 and 16, respectively. Diageo is barely above the trade common of 17.7. This helps a thesis of restricted worth development going ahead. A price-to-sales (P/S) ratio of three.85 and price-to-book (P/B) ratio of 8.2 additional assist this thesis.

However Diageo is a multinational retail big with prime manufacturers like Smirnoff, Guinness and Johnnie Walker – what’s holding it again?

Financial tightening and fewer drinkers

Final yr, premium alcohol gross sales figures in Latin and South America got here in signifcantly decrease than anticipated. However that’s not the one area slowing down. European gross sales have additionally been sluggish as ongoing financial uncertainty has led to decreased spending on premium items.

Alcohol expenditure amongst youthful generations has been declining for a while now too, significantly within the UK. A current well being survey discovered fewer younger folks drink alcohol for each well being causes and affordability. The same development is obvious within the US, the place solely 62% of adults underneath 35 say they drink, in comparison with 72% 20 years in the past.

That stated, eating places and bars worldwide proceed to inventory Diageo’s manufacturers – and can possible proceed to take action for the indefinite future. Let’s be trustworthy, whereas decrease alcohol consumption could damage gross sales, it’s a web constructive for society general.

Future prospects

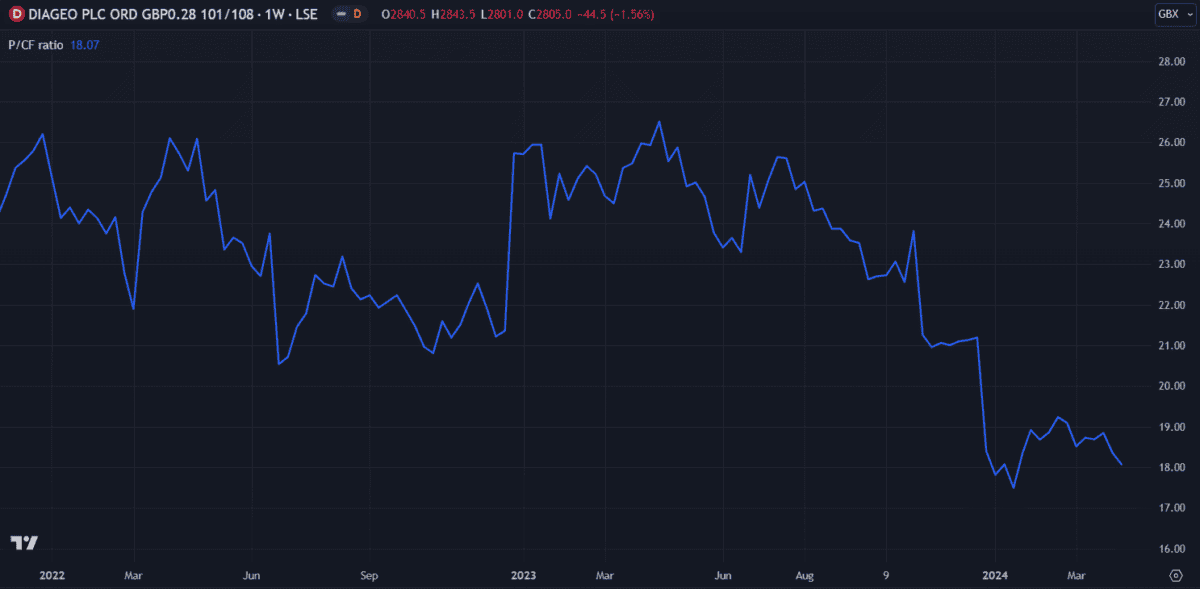

The worth-to-cash move (P/CF) ratio has declined with the value, indicating secure money move. Utilizing a discounted money move mannequin, analysts estimate the shares at the moment are undervalued by round 28%.

However this doesn’t essentially equate to a lot worth development within the close to future.

Impartial evaluation estimates a median 12-month worth goal of £30 – an 8% rise from present ranges. It appears to me the value might commerce sideways within the present £26 to £30 vary for the remainder of the yr.

Whereas Diageo stays a powerful trade chief, I don’t anticipate the share worth to interrupt £30 till the weakened financial outlook improves. Nonetheless, I’ll maintain my shares for now as I imagine the corporate has long-term worth.

[ad_2]