[ad_1]

Certainly one of my readers picked me up on my articles about the usage of buyer information, AI and open banking final week, saying that I had missed a vital level. What had I missed? Properly, the discussions had been primarily about the usage of buyer information for advertising, recommendation, security, safety, threat and compliance … nevertheless it’s greater than this. It’s additionally about ethics.

They made clear that the majority banks have a purely ‘industrial’ view of compliance, as in that there could also be regulatory fines … however that is simply the price of doing enterprise. The extra perception they gave me is that there could also be the next threat of alienating prospects by not managing stakeholder dangers round ethics.

By means of instance, an unbiased evaluation of JPMorgan’s ethics discovered them to be doing fairly effectively. This report by Ethics Grade on JPMorgan’s ethics, produced, an unbiased ESG firm powered by AI, offers perception.

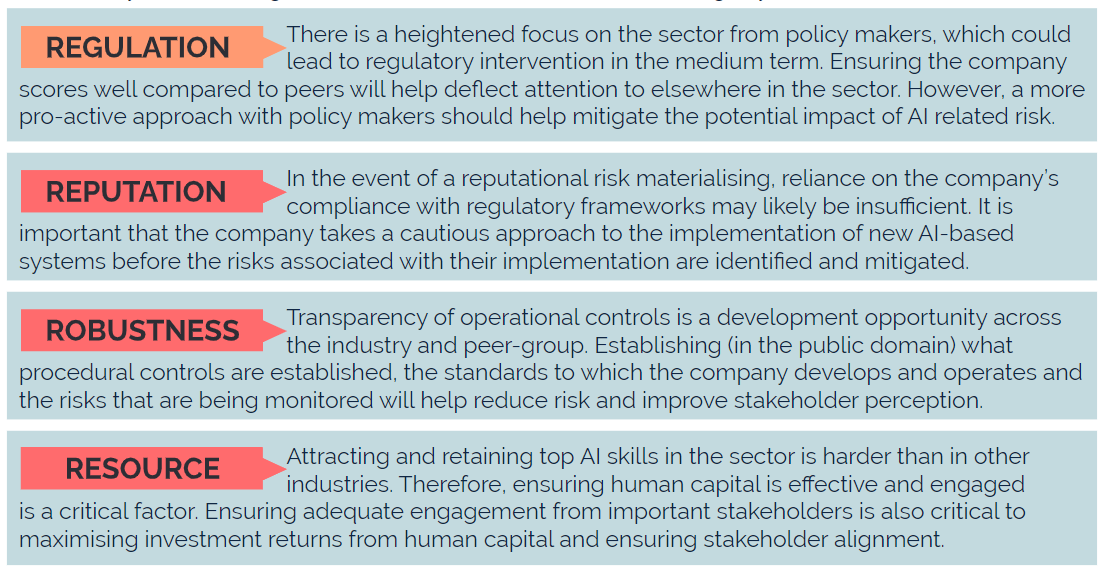

Two issues stood out for me on this report. The primary is the scorecard used, which balances the banks dedication to regulation, status, robustness and resaourfe dangers.

That’s a pleasant scorecard.

The second is that JPMorgan is third of their peer group for ethics and within the 83rd percentile of all firms, ranked as a C grade. In different phrases, they’ve scored fairly effectively, and are within the high 4 out of 5 companies for ethics. Woo-hoo! However they may nonetheless do higher, as evidenced one other latest report that discovered American banks particularly to be fairly unethical when it got here to investments in firms that trash the planet and promote weapons to enemies of the state.

US banks named as being amongst least moral UK operators

Two US banking giants … have been ranked among the many “worst” suppliers by researchers due to their insurance policies on points such because the local weather disaster and weapons. Goldman Sachs and JPMorgan Chase each scored poorly resulting from their information on the surroundings, human rights and paying tax, based on a brand new research by Moral Shopper journal.

This implies there may be appreciable room for enchancment. So, what to do? What to do is to be moral by design. What does that imply? Properly, one other pal despatched me this report that relates particularly to this house:

Written by Charles Radclyffe and Richard (Dick) Nodell*, it’s an fascinating tackle the topic.

The paper dropped in 2020, and mirrored on the scandal associated to Cambridge Analytica/Fb, and handle ethics within the context of digital applied sciences. They state that the issue shouldn’t be merely that ethics, as a website of governance, shouldn’t be effectively understood by the expertise business, however that it’s both restricted in mainstream dialogue to a dialogue of threat and questions of safety, or it’s conflated with regulatory compliance.

The phrases used to for buildings to handle ethics, resembling ‘Ethics Boards’ and ‘Ethics Councils’ are additionally used interchangeably.

Charles and Dick’s paper proposes to outline digital ethics in phrases the place it turns into clear that it’s seen as a very separate subject of governance to regulatory compliance, technical threat and security administration.

Properly price a learn and, total, I agree. Ethics is a subject in its personal proper and more and more necessary in as we speak’s world of buyer information abuse however, imho, it must be a part of a improvement of a whole information mannequin that includes threat, regulation, advertising, recommendation and digital information analytics basically.

* Charles is a Forbes contributor and has introduced all over the world on topics regarding the sector of expertise and societal change, together with two TEDx talks which can be found on-line. Richard (Dick) has a profession that spans over 4 many years, specialised in working with leaders of enormous advanced organisations together with Goldman Sachs, American Specific, IBM, and AT&T.

[ad_2]