[ad_1]

Picture supply: Getty Pictures

The Tesco (LSE:TSCO) share value skilled sturdy development within the second half of 2023, nevertheless it’s made a weak begin to the brand new 12 months. JPMorgan Cazenove just lately slashed its value goal for Britain’s largest grocery inventory to 220p. That’s effectively beneath at the moment’s value of 282p per share.

So are Tesco shares displaying indicators of exhaustion? Or can traders anticipate this FTSE 100 inventory to ship good returns in 2024?

Right here’s what the charts say.

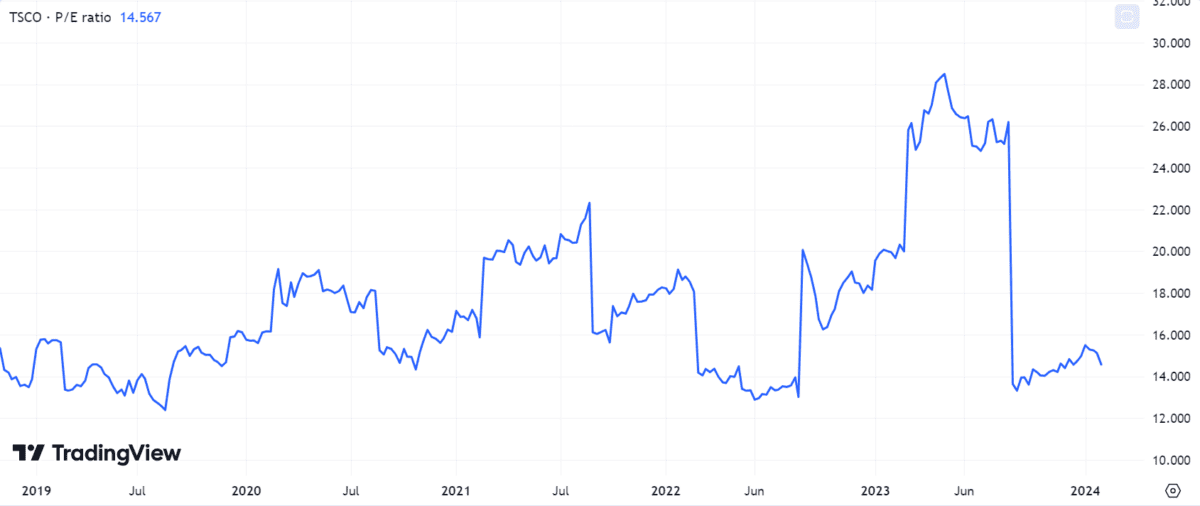

Valuation

At first look, Tesco’s price-to-earnings (P/E) ratio above 14.5 won’t appear particularly low-cost relative to the broader FTSE 100 index. Nonetheless, this a number of is in the direction of the underside finish of the place the inventory has traded over the previous 5 years.

As well as, the ahead P/E ratio is somewhat decrease, at round 12.3. I wouldn’t say that’s discount basement territory, however equally the shares don’t look significantly costly both.

The grocery big expanded its market share over the essential Christmas interval. Furthermore, the board upgraded this 12 months’s adjusted working revenue steerage for Tesco’s retail enterprise from a variety of £2.6bn-£2.7bn to £2.75bn.

In that context, the valuation doesn’t give me an excessive amount of trigger for concern at current.

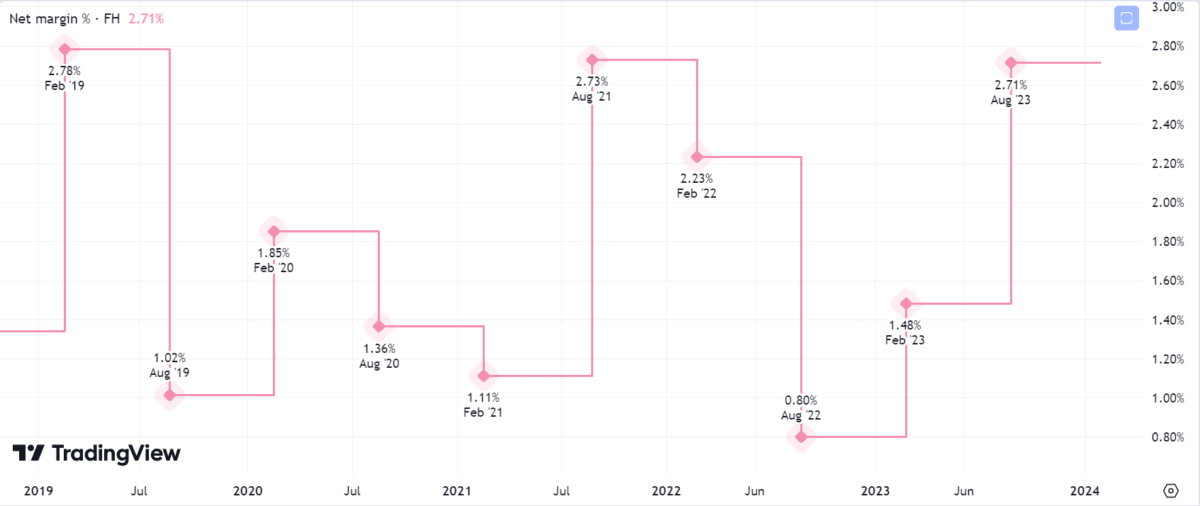

Margins

Nonetheless, I do see margins as an even bigger fear for the long run course of the Tesco share value.

On the brilliant facet, Tesco’s web margin has held up effectively regardless of current value inflation. That mentioned, wanting again over the previous 5 years it’s been a little bit of a rollercoaster journey, which displays the extreme competitors within the sector.

Robust gross sales have been helped by value cuts on nearly 2,700 merchandise in an effort to stave off worth rivals like Aldi and Lidl. Whether or not the enterprise can maintain this technique whereas preserving wholesome margins stays to be seen. It gained’t be a simple process.

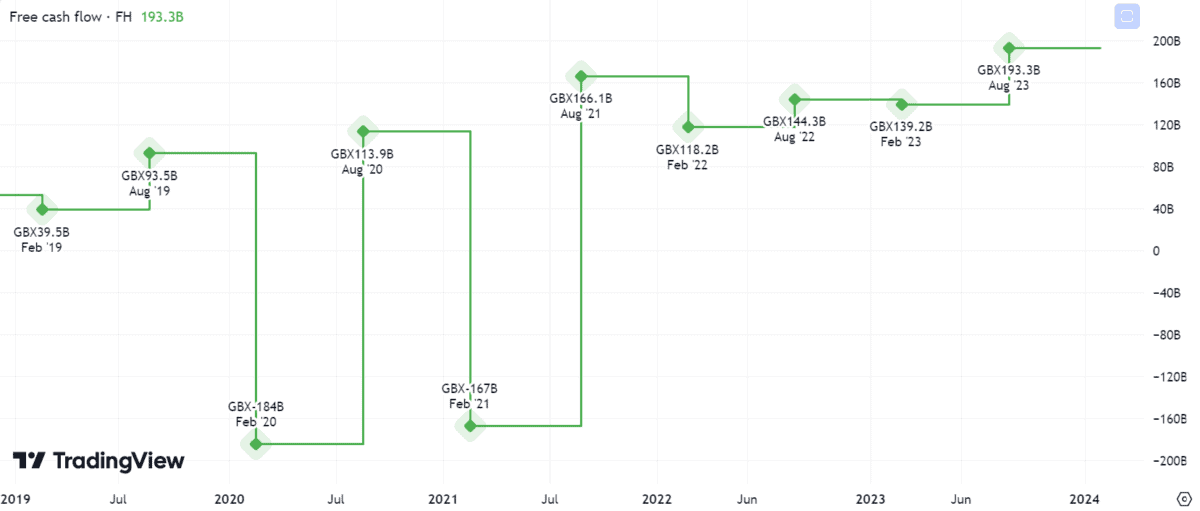

Free money stream

Nonetheless, there’s a lot to cheer on the free money stream entrance. Regular enchancment on this metric over the previous couple of years has been significantly encouraging.

Sturdy free money stream is important in supporting dividend distributions. With a wholesome ahead yield of 4.1% and strong forecast cowl of two.1 instances earnings, Tesco shares look well-placed to proceed offering a gentle stream of passive earnings.

After all, no dividends are assured. In any case, the grocery store didn’t pay any in 2016 and 2017 amid the fallout from a dangerous accounting scandal.

The place subsequent for the share value?

There are some medium- and long-term dangers for the way forward for the Tesco share value, particularly within the type of rising competitors.

Nonetheless, the corporate has fended off these challenges effectively thus far and up to date outcomes present loads of promise. As such, I feel it’s too early to name time on the Tesco share value rally and the inventory might climb additional in 2024.

Any signal of margin compression could be a crimson flag and one traders ought to monitor rigorously. Nonetheless, offered the corporate continues to exhibit power in its financials, I’m comfortable to proceed holding my place.

General, I consider it is a inventory that traders ought to take into account for 2024.

[ad_2]