[ad_1]

That is fairly a sophisticated replace, but it surely got here to thoughts once I noticed that JPMorgan analysts are predicting stablecoins might destabilise the standard monetary markets. It’s because the Federal Reserve determined in April that cash funds created for the only real goal of accessing its in a single day reverse repo facility, which is known as ON RRP, had been deemed ineligible as a counterparty.

So, if you’re a brand new start-up wanting entry to stabilise your funds in a single day, you want entry to ON RRP. Should you don’t have it, then you will have much more potential volatility. That’s the difficulty.

First query: what’s RRP?

A reverse repurchase settlement (RRP) is a transaction by which the buying and selling desk sells a safety to a different monetary establishment (counterparty), with an settlement to repurchase that very same safety at a specified worth at a particular time sooner or later. Making it less complicated, think about you will have $1 million. In a single day, you may park that $1 million with a financial institution figuring out that, within the morning and even in a month, it can nonetheless be value $1 million.

The problem JPMorgan highlights is that stablecoins searching for to park money and unable to entry the Federal Reserve financial institution’s facility, must compete with the $5.64 trillion money-market fund trade. It will transfer them to search for different securities and belongings like Treasury payments, T-bills for brief, and doubtlessly pushing these charges under the providing degree on the RRP.

Did I say this was sophisticated? What does it imply? Properly, if stablecoins develop in worth, and have to purchase T-bills and different belongings, reasonably than gaining access to the repo markets, then confidence within the American system would possibly fall by way of the ground.

Let’s have a look at this in slightly extra element. Based on Investopedia, falling yields point out warning within the markets and, if stablecoins push down T-bill charges then the US, historically seen as a secure haven for capital, can be impacted by a lack of confidence. Protecting JPMorgan’s report, Bloomberg states:

“The mixed reserve portfolios of the 2 largest stablecoins — Tether and USDC — was $114 billion as of June 2023, with over 60% in T-bills and 25% in repo. Regardless that they solely symbolize 2% of the invoice market, the strategists mentioned extra development in stablecoins might crowd out different patrons and intensify the supply-and-demand imbalance within the money-market area, resulting in shortages in T-bills and repos, pushing charges even decrease.

“Because the variety of stablecoin issuers develop and enter short-term funding markets, there’s additionally an growing publicity of the standard monetary system to turbulence within the crypto area.

“For instance, the collapse of TerraUSD in Could 2022 underscored how rapidly a run might happen within the short-term charges area. That’s as a result of a swift and large liquidation of different prime quality liquid belongings similar to Treasury payments by one stablecoin issuer might affect the web asset worth of different issuers and money-market funds holding T-bills, prompting much more liquidations.”

The rationale why I’ve posted that is that I discover it attention-grabbing the place we now have reached a stage the place cryptocurrencies and stablecoins have gotten so mainstream that they may destabilise conventional monetary methods. How rapidly instances change.

Postscript:

Slightly extra background on repo markets courtesy of the ICMA (the Worldwide Capital Market Affiliation).

Repo is a generic identify for each repurchase transactions and purchase/sell-backs.*

In a repo, one social gathering sells an asset (often fixed-income securities) to a different social gathering at one worth and commits to repurchase the identical or one other a part of the identical asset from the second social gathering at a unique worth at a future date or (within the case of an open repo) on demand.** If the vendor defaults through the lifetime of the repo, the client (as the brand new proprietor) can promote the asset to a 3rd social gathering to offset his loss. The asset due to this fact acts as collateral and mitigates the credit score danger that the client has on the vendor.

Though an asset is bought outright at the beginning of a repo, the dedication of the vendor to purchase again the asset sooner or later implies that the client has solely short-term use of that asset, whereas the vendor has solely short-term use of the money proceeds of the preliminary sale. Thus, though repo is structured legally as a sale and repurchase of securities, it behaves economically like a collateralised or secured deposit (and the principal use of repo is in reality the secured borrowing and lending of money).

The distinction between the value paid by the client at the beginning of a repo and the value he receives on the finish is his return on the money that he’s successfully lending to the vendor. In repurchase transactions, and now often within the case of purchase/sell-backs, this return is quoted as a share every year fee and is known as the repo fee. Though not legally appropriate, the return itself is often known as repo curiosity.

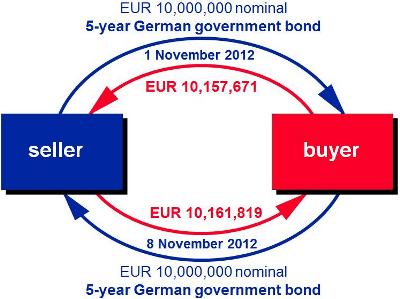

An instance of a repo is illustrated under.

The customer in a repo is commonly described as doing a reverse repo (ie shopping for, then promoting).

A repo not solely mitigates the client’s credit score danger. Supplied the asset getting used as collateral is liquid, the client ought to be capable of refinance himself at any time through the lifetime of a repo by promoting or repoing the belongings to a 3rd social gathering (he would, in fact, subsequently have to purchase the identical or an analogous asset again with a view to return it to his repo counterparty on the finish of the repo). This proper of use (usually referred to as re-use) mitigates the liquidity danger that the client takes by lending to the vendor. As a result of lending by way of a repo exposes the client to decrease credit score and liquidity dangers, repo charges ought to be decrease than unsecured cash market charges.

* Repos are generally referred to as ‘sale-and-repurchase agreements’ or simply ‘repurchase agreements’. In some markets, the identify ‘repo’ will be taken to suggest repurchase transactions solely and never purchase/sell-backs. Repurchase transactions are also called ‘basic repo’. Beneath EU regulation — together with securities lending, commodities lending and margin lending — repurchase transactions and purchase/sell-backs are sorts of ‘securities financing transaction’ (SFT).

** Within the World Grasp Repurchase Settlement (GMRA), the identical or comparable belongings are described as ‘Equal Securities’. ‘Equal’ means belongings which can be economically however not essentially legally equivalent (the identical difficulty of securities with the identical ISIN or, if the difficulty is split into lessons or tranches, the identical class or tranche, however not the identical a part of that difficulty, class or tranche).

[ad_2]