[ad_1]

Picture supply: Getty Pictures

There was an avalanche of positivity surrounding Rolls-Royce (LSE: RR) shares during the last yr. And rightly so, because the turnaround in enterprise efficiency below chief government Tufan Erginbilgiç has been fairly dramatic.

This was mirrored within the unimaginable 220% share worth in 2023. Certainly, this made the FTSE 100 engine maker the best-performing blue-chip throughout the entire of Europe final yr.

Nevertheless, I wish to deal with a few key dangers as we enter the New Yr.

Pandemics and pricing

As we all know, the pandemic was totally devastating to Rolls-Royce’s funds. This was as a consequence of its enterprise mannequin, the place the corporate will get paid when plane powered by its engines are within the sky (measured as time on wing).

When there have been no planes within the skies, with none needing common servicing, the corporate went into survival mode. Jobs had been shed, belongings had been disposed of, and big debt was taken on.

Whereas issues are actually significantly better, one other world well being emergency could be an enormous setback. And it could possibly’t be dominated out.

Proper now within the US, China and elsewhere, a brand new variant of the coronavirus virus referred to as JN.1 is spreading quickly. It’s too early to inform how harmful that is, however scientists say the development might be exacerbated by mass journey in China across the Lunar New Yr.

China is a key marketplace for Rolls-Royce and a rustic the place the authorities don’t mess about with regards to imposing lockdowns.

Additionally, the CEO has been renegotiating contracts with enterprise companions. This could bear fruit long run, however within the meantime there might be pushback on pricing.

In spite of everything, the widebody airline market has fairly a small variety of essential gamers. With Rolls enjoying hardball, buyer relationships might be broken.

It’s occurred earlier than

As unusual because it sounds, buyers who purchased initially of 2023 would nonetheless be doing superb even when Rolls shares did fall to £1.50 this yr. They’d nonetheless be up round 60% or so, because the shares had been 93p again then.

In fact, that’s not how most buyers would see issues. And I purchased my shares at round £1.49 final yr, so I’d see my roughly 100% acquire (as I write) virtually utterly worn out.

Such issues have occurred to me earlier than. Between early 2020 and late 2022, I watched in horror as my holding in Shopify went from a 300% acquire to being down 25%.

Shares usually do take the steps up and the elevator down, because the outdated investing saying goes.

Fortunately, I held on and issues are again on monitor, however these large dips might be painful as an investor. They usually can by no means be discounted.

A variety

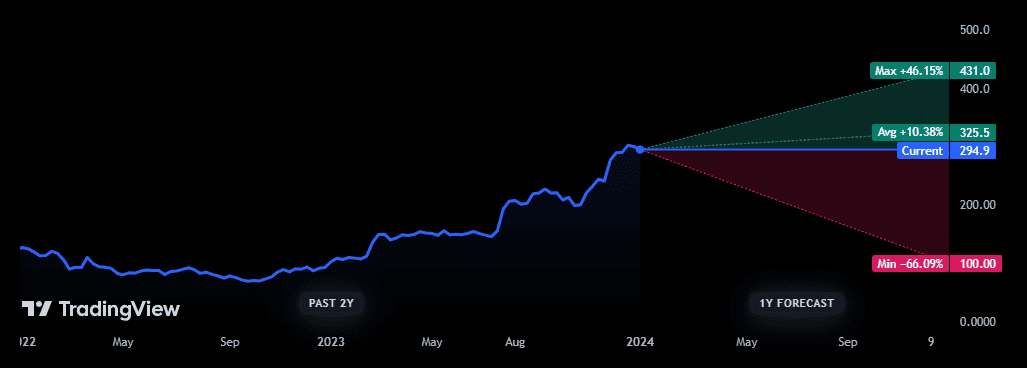

Finally, it’s unsure the place the shares shall be by the tip of this yr. We will see this within the large share worth goal vary given by brokers for the following 12 months.

The consensus bull-case situation sees the share worth topping £4.31. Nevertheless, the bear case from some analysts requires a share worth of simply £1.

What ought to I do confronted with this uncertainty?

Regardless of the dangers, I’m going to maintain holding my place in 2024. I’m bullish on the share worth and stay longing for extra positive factors.

[ad_2]