[ad_1]

Picture supply: Getty Photographs

Recently, it has appeared like each single main index on the earth has hit a brand new document excessive aside from the FTSE 100.

Nonetheless, that is perhaps about to alter as a result of the Footsie has been creeping up and is now inside placing distance of the 8,000 factors it briefly reached in early 2023.

Right here’s why I believe it should breeze previous its document shut of 8,012 this yr.

It’s all in regards to the charges

The market now seems to be pricing in three central financial institution rate of interest cuts by the tip of this yr. That might take the bottom price right down to 4.5%.

That’s not an unreasonable assumption on condition that inflation has been falling quickly.

In truth, Financial institution of England Governor Andrew Bailey stated markets are “cheap” to anticipate multiple price minimize in 2024 on condition that UK inflation is transferring within the “proper course”.

In comparison with his often cautious tone, that’s truly bullishness.

In the meantime, forecasts for FTSE 100 earnings, dividends, and buybacks stay robust for this yr and subsequent.

Given all this, it’s onerous to not be optimistic. And I’ve simply been studying that economists at KPMG see rates of interest falling to three% in 2025. In that situation, shares will certainly rise, received’t they?

Inviting egg on my face then, I’m going to say the FTSE 100 will finish the yr above 8,500.

This inventory might have additional to run

One Footsie share I see persevering with to do nicely is Pershing Sq. Holdings (LSE: PSH).

That is the funding belief automobile of billionaire hedge fund supervisor Invoice Ackman.

The share value has been on an absolute tear, rising 48% in a single yr and 212% over 5.

In 2023, Pershing generated a 26.7% internet return, barely forward of the S&P 500. Extremely, this was achieved solely holding one of many ‘Magnificent Seven’ (Alphabet).

Since inception in 2004, the fund has delivered a cumulative complete internet asset worth (NAV) return of two,078% versus 592% for the S&P 500.

This has been achieved by means of holding a really concentrated portfolio of 8-12 shares, in addition to perfectly-timed macro bets utilizing derivatives (frequent for hedge funds).

In early 2020, for instance, Ackman made $2.6bn from a $27m outlay – virtually a 100-fold return – betting {that a} Covid outbreak would trigger a market crash. This opportunism helped offset the steep market falls.

In fact, derivatives add complexity and may improve threat. And the high-conviction portfolio means one or two laggards might drag badly on annual efficiency.

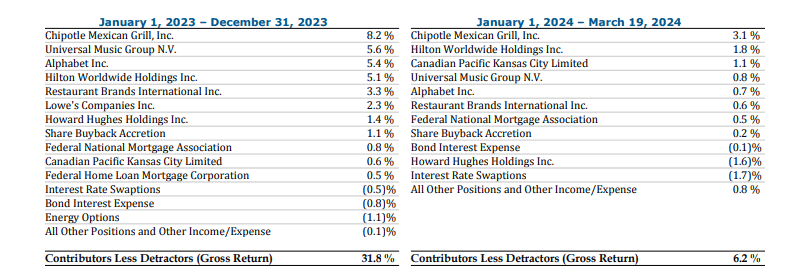

Under are the contributors and detractors to efficiency in 2023 and 2024 (as much as 19 March).

Regardless of this outperformance, the shares at £41 are nonetheless buying and selling at a 23% low cost to the fund’s NAV. A perennial situation right here has been the excessive administration and efficiency charges.

Nonetheless, Ackman’s long-term purpose is to scale back efficiency charges to zero with robust returns and the launch of latest funds. A kind of forthcoming funds is a US-listed one known as Pershing Sq. USA.

It’s going to largely mirror the established funding technique, however with out extra efficiency charges. Ackman goals to boost $10bn for this.

I believe this fund’s launch, coupled with a rising FTSE 100, might see the inventory head greater. I’m already a shareholder, however I’d fortunately make investments once more with spare money.

[ad_2]