[ad_1]

We’re in a dreaded sideways market. Drifting with out drama, besides that I can hear the faint hiss of a leak because the Sluggish & Regular portfolio deflates 0.33% this quarter.

If it wasn’t for having to put in writing this replace, I admit I’d be executing Operation See-No-Evil. Not even taking a look at the marketplace for months, perhaps years, till this glum interval passes.

Passive investing is the secret – and it doesn’t encourage actively urging in your portfolio from the sidelines like Ted Lasso shouting impotently at his struggling group.

Nonetheless, check-in I need to.

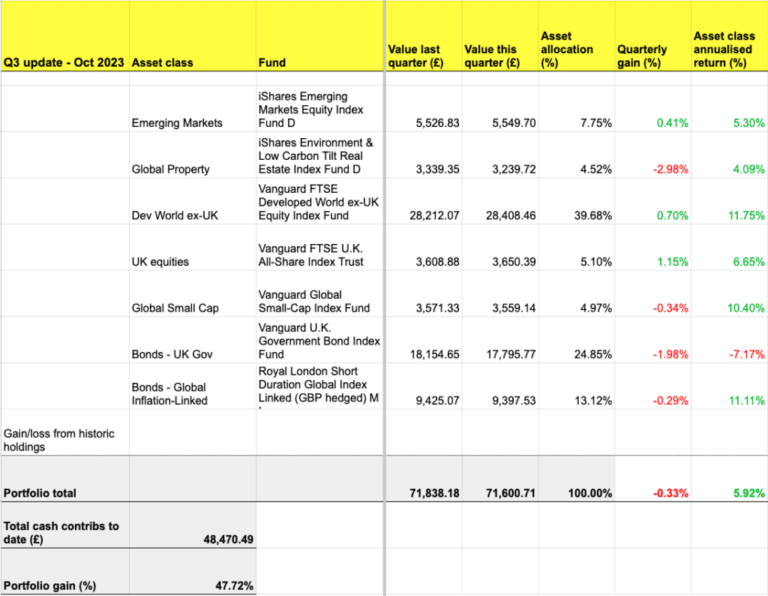

Virtually inevitably we are able to see it’s authorities bonds – and property – which might be holding us again this quarter:

The Sluggish & Regular portfolio is Monevator’s mannequin passive investing portfolio. It was arrange firstly of 2011 with £3,000. An additional £1,200 is invested each quarter right into a diversified set of index funds, tilted in the direction of equities. You may learn the origin story and discover all of the earlier passive portfolio posts tucked away within the Monevator vaults.

The Sluggish & Regular’s total return after virtually 13-years is 5.9% annualised. Let’s name that 3% after inflation.

Respectable, however I can’t assist however surprise how many people received’t go completely crazy if our portfolios proceed to spin their wheels for the subsequent a number of years.

How probably is that? How lengthy will we’ve to attend for the gloom to raise?

Let’s see what number of misplaced a long time UK traders have endured down the years.

Misplaced a long time

Most individuals’s investing destiny might be dominated by their equities, not bonds. And the excellent news is there are few a long time when shares really go backwards. The even higher information is that the follow-on decade is usually spectacular.

The desk under exhibits the misplaced a long time that beset World equities, the rebound that adopted, plus the yr the portfolio turned optimistic once more. (See the ‘Again within the black’ column).

Word: returns are actual annualised whole returns. In different phrases, they present the common annual return (accounting for positive factors and losses), are inflation-adjusted, and embody the affect of dividends.

World equities: misplaced a long time since 1970

World equities have suffered two misplaced a long time previously half century:

| Misplaced decade | Ann return (%) | +10 years (%) | Again within the black |

| 1970-79 | -5.8 | 11.1 | 1984 |

| 1999-2008 | -0.9 | 8.5 | 2009 |

Information from MSCI, compiled by Monevator

The stagflationary ’70s weren’t an period for checking your shares six instances a day. Six instances in the whole decade would have been an excessive amount of.

However have a look at the 11% annualised return over the subsequent ten years! That’s greater than double the historic common of 5%. If you happen to prevented self-destruction throughout the wilderness years then you definately had been richly rewarded throughout the go-go Nineteen Eighties.

Fairly just a few Monevator readers may have made their investing debuts throughout the subsequent misplaced decade, which adopted the Dotcom mania of the late ’90s. I keep in mind colleagues frothing down the pub about their newfound riches and the way “the Web has modified the whole lot”.

It had and it felt prefer it was raining cash.

Then the rains failed.

Trying again the annualised returns from 1999 to 2008 weren’t dreadful. The Noughties had been a good decade. However they had been spit-roasted by the Dotcom Bust and the International Monetary Disaster (GFC).

Fortunately confidence was restored by a V-shaped restoration from 2009. The 8.5% annualised returns scooped up over the subsequent ten years helped set up DIY investing as on-line platforms proliferated.

It might be a harder promote now although, as a portion of these positive factors had been in all probability borrowed from the long run by way of excessive valuations. Such frothiness might must be paid for by a number of mediocre years to return.

UK equities: misplaced a long time since 1825

What about shares right here in Blighty? UK equities have solely posted 4 misplaced a long time in two centuries:

| Misplaced decade | Ann return (%) | +10 years (%) | Again within the black |

| 1907-16 | -0.2 | 4.1 | 1924 |

| 1943-52 | -0.06 | 12.4 | 1953 |

| 1965-74 | -5.4 | 7.8 | 1975 |

| 1999-2008 | -0.7 | 6.5 | 2009 |

Information from Rule Britannia, JST Macrohistory and FTSE Russell, compiled by Monevator

UK equities didn’t undergo a single misplaced decade from 1825 to 1907. These actually had been the nice outdated days.

Even with the primary entry in our desk, 1907 to 1914 was really a raging bull market till World Battle One derailed the whole lot.

The next ten years had been sub-par, however not horrible when you think about the Spanish Flu pandemic that killed hundreds of thousands and the financial despair that settled throughout Britain and the remainder of Europe.

World Battle 2 is an actual eye-opener, given the size of real-world destruction. The market recovered shortly as post-war inflation dissipated. Returns from 1953 to 1962 are the very best of these following the entries in our Misplaced Decade tables.

Take coronary heart

So don’t really feel despondent pricey reader. Clearly issues have been a lot worse for a few of our investing forebears. We’re removed from misplaced decade territory proper now.

In reality, misplaced a long time will not be that frequent, however lengthy stretches of down years are. They’re not an indication that something is damaged. They might nicely herald that the very best years in your explicit investing lifetime are but to return.

inventory market returns by means of this lens jogs my memory investing is a long-term recreation – and that it will possibly really feel even longer!

It might probably take a few years of grinding earlier than we benefit from the hoped-for rewards.

New transactions

Each quarter we blow £1,200 onto the market cube and hope to roll a six. Our stake is break up between seven funds in accordance with our predetermined asset allocation.

We rebalance utilizing Larry Swedroe’s 5/25 rule. That hasn’t been activated this quarter, so the trades play out like this:

UK fairness

Vanguard FTSE UK All-Share Index Belief – OCF 0.06%

Fund identifier: GB00B3X7QG63

New buy: £60

Purchase 0.246 models @ £244.28

Goal allocation: 5%

Developed world ex-UK equities

Vanguard FTSE Developed World ex-UK Fairness Index Fund – OCF 0.14%

Fund identifier: GB00B59G4Q73

New buy: £444

Purchase 0.804 models @ £552.29

Goal allocation: 37%

International small cap equities

Vanguard International Small-Cap Index Fund – OCF 0.29%

Fund identifier: IE00B3X1NT05

New buy: £60

Purchase 0.158 models @ £378.69

Goal allocation: 5%

Rising market equities

iShares Rising Markets Fairness Index Fund D – OCF 0.21%

Fund identifier: GB00B84DY642

New buy: £96

Purchase 54.201 models @ £1.77

Goal allocation: 8%

International property

iShares Setting & Low Carbon Tilt Actual Property Index Fund – OCF 0.17%

Fund identifier: GB00B5BFJG71

New buy: £60

Purchase 29.241 models @ £2.05

Goal allocation: 5%

UK gilts

Vanguard UK Authorities Bond Index – OCF 0.12%

Fund identifier: IE00B1S75374

New buy: £324

Purchase 2.603 models @ £124.46

Goal allocation: 27%

International inflation-linked bonds

Royal London Quick Length International Index-Linked Fund – OCF 0.27%

Fund identifier: GB00BD050F05

New buy: £156

Purchase 150.87 models @ £1.03

Goal allocation: 13%

New funding contribution = £1,200

Buying and selling price = £0

Check out our dealer comparability desk on your greatest funding account choices. InvestEngine is at the moment most cost-effective for those who’re completely satisfied to speculate solely in ETFs. Or be taught extra about selecting the most cost-effective shares and shares ISA on your circumstances.

Common portfolio OCF = 0.16%

If this all appears too sophisticated try our greatest multi-asset fund picks. These embody all-in-one diversified portfolios, such because the Vanguard LifeStrategy funds.

Fascinated with monitoring your individual portfolio or utilizing the Sluggish & Regular funding monitoring spreadsheet? Our piece on portfolio monitoring exhibits you ways.

Lastly, be taught extra about why we predict most individuals are higher off selecting passive vs lively investing.

Take it regular,

The Accumulator

[ad_2]